Views

This article was originally published on NCrypted.

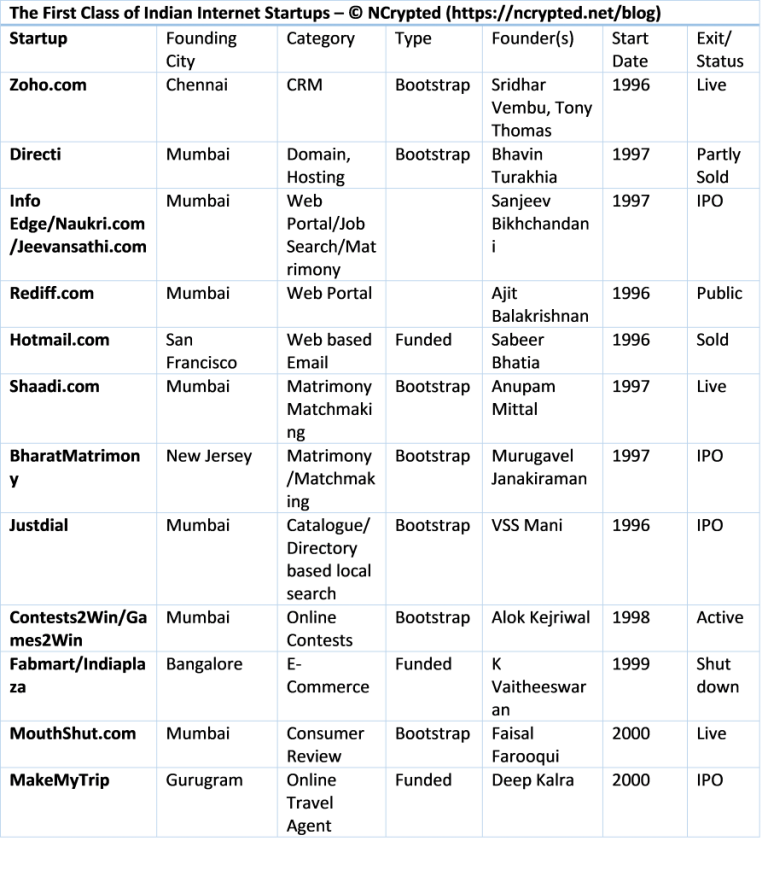

You are wrong if you think Flipkart pioneered the Indian startup story. It wasn’t even India’s first E-Commerce startup. Of course, Flipkart’s recent US$16 billion acquisition by Walmart (for a 77% stake) ‘sort of’ validated the Indian startup story. But, it wasn’t the pioneer of this saga. Flipkart can be contributed as the Indian startup story’s poster boy as many founders and entrepreneurs got inspired by the success that it witnessed following its famous funding rounds after 2011.

But, long before Flipkart, Paytm and Snapdeal came and launched their primary platforms between late 2007 and 2010, India quietly witnessed the launch and demise of many relatively unknown startups that can be contributed to laying the foundation of the ecosystem in the country. The majority of these first class startups are public profitable companies today, a few got sold, a few are operating but remain relatively unknown to the masses, while some have pivoted their business models and a few have shut shops.

For the definition, I am considering the startups launched before 2000 as the first class and the ones between 2000 and 2007 as the second class. We will talk about the second class of the startups in my next article that further laid the ground rules for the more famous horde that came later between 2007 and 2015.

Some of these first class startups literally laid the foundation in an unorganized startup sector in India, in times when India didn’t have sufficient digital infrastructure and only some lucky households had dial-up internet connection. There were no popular VC jargon back then such as traction, LTV, CAC and there was no startup-investor ecosystem at all. Investors didn’t know how and why to invest in such companies (forget ideas) and angels were yet to be discovered!

We are talking about the times when consumers had to go out to what was known as an ‘ISD STD PCO’ to make phone calls outside the city and country. Only a handful of internet cafes were providing internet surfing facility at hefty prices. It is during this time that some of the early entrepreneurs dared to dream big and saw the impossible that laid the foundation of the future Flipkarts, Olas and Paytms of the country.

Despite the lack of any proper institution, ecosystem and facilitation, these early entrepreneurs of the first dotcom wave in India went on to dream big. They self-taught everything on finding the product-fit, market-fit, getting customers, marketing to the consumers about an internet business in an era when there were not enough landline phone connections in the households! They had to self-learn fundraising in an era which had almost no venture capital or business angel in the country. These are no-nonsense founders who did not have any startup schooling and despite all the odds, went on to start their dotcom ventures – many failed, some did succeed, but all of them went on to form which we can proudly call the first class of the Indian dotcom era.

As a witness to the rise of the first class when I was in my early teens and as a struggling entrepreneur myself during the wave of the second class, I feel astonished while telling you this story.

Let the first class begin!

Zoho – A true Indian product-based software company

In 1996, Sridhar Vembu and Tony Thomas started a software development company called Advent Inc. in California, USA. The company launched a web based word processor named Zoho in 2005 and later expanded its online office suites to include additional products such as spreadsheets and presentations. Zoho became the pioneer among Indian companies to offer this package in the form of software-as-a-service (SaaS). In 2009, the company got renamed as Zoho Corporation after its popular online office suit of the same name.

Where is Zoho Today?

Today Zoho has offices in seven countries with its global headquarters in Chennai, India. Zoho is giving tough competition to ZenDesk (Help Desk), Salesforce (CRM), Google Office (Cloud based Office Solutions) and other industry leaders in the respective fields. Zoho is majorly owned by Sridhar and is consider a Unicorn (a startup with over a billion dollar in private valuation) in its true respect.

Leading the Bootstrap Wave

What makes the Zoho case exciting is that it is completely bootstrapped and is doing multi-million dollar business today. The company is in fact proud of the fact that it has never raised external venture capital.

Bootstrapping is the concept wherein a startup has raised capital from the founders and their friends, family and fan (FFF – Fan is sometimes referred to as ‘Fool’, pun intended!) and has gradually then financed itself from its operating profits, without any external venture capital or angel funding by diluting company shareholding.

Sridhar Vembu is a big fan of bootstrapped startups. Bootstrap, according to Sridhar is, “starting in a year minus five rather than year zero. And you spend those five years learning business, learning how to build a product, how to sell, how to service customers, how to collect money and may be, how to manage employees.” Sridhar doesn’t agree that you can learn the art of starting up your own business in any business school. “None of these things actually can be learnt in any kind of school. And business school is actually a misnomer that way, because it cannot really teach business to you. You can only learn business by doing it.”

“None of these things actually can be learnt in any kind of school. And business school is actually a misnomer that way, because it cannot really teach business to you. You can only learn business by doing it.”

Sridhar Vembu – Zoho

Directi – Hosting other Indian dotcoms

In 1998, at the age of 18 and with a capital borrowing of 25,000 Rs. from their father, two Gujarati brothers Bhavin and Divyank Turakhia, started tech consulting firm from their shared bed room in Mumbai. Little did they know that they would become tech billionaires one day!

The business did well and they were not only able to repay the loan, but were profitable within a year. That was the time when domain registration and web hosting was a foreign concept to many Indian companies and that is what struck to the brothers’ mind during their consulting years. They found a key pain point the dotcom industry in India needed to be solved. This lead them to start their domain registration, reselling and hosting business in early 2003 and later became an ICANN accredited domain registrar. The company under the brand name of Directi was managing different verticals for different operations such as Resellerclub, LogicBoxes, BigRock etc.

The Multi-Million Dollar Exit – Multiple Times!

In 2014, the brothers sold four of their web companies – BigRock, LogicBoxes, ResellerClub, and Webhosting.info for US$160 million, to NASDAQ listed US based web hosting company Endurance International Group.

The brothers already owned a private jet plane before the deal, however the deal made them multi-millionaires while they were still in their early 30s.

As if this wasn’t enough, in 2016, the Turakhia brothers sold off their Dubai based ad tech firm Media.net, which they started in 2010, to a Chinese consortium for US$900 million – the deal made them billionaires and catapulted them to the Forbes List of India’s 100 Richest People (2016). The deal is one of the largest bootstrap exits worldwide.

What is Directi doing Today?

After selling some of their most successful businesses including Media.net, ResellerClub, BigRock, LogicBoxes, Directi still operates Flock, Ringo, Zeta and CodeChef.com.

Psst! What to consider before starting up?

Info Edge – Pioneering Consumer Centric Startups in India

Sanjeev Bikhchandani founded Info Edge in 1995 with a business partner. Info Edge was in the business of database collection of job seekers and acted more in the lines of a job search consultant. Sanjeev launched Naukri.com in 1997 and went online with the business.

Naukri.com – India’s First Online Job Portal

Naukri.com was founded by Sanjeev Bikhchandani in 1997, who was already running Info Edge (India) Pvt. Ltd, as a job portal with a database of job seeker resumes, job listings and job consultants. Sanjeev earlier quit his job at Glaxo Smithkline to start Info Edge for arranging job seekers database and in the process collected important data such as current salaries of employees across categories. Sanjeev then sold the salary reports to Engineering and MBA college graduates for a fee.

The business model was pretty similar to Monster.com. However, like almost every other entrepreneur of this first-class generation, Sanjeev had to teach himself on how to use the internet and WWW in the early 90s.

With the help of other co-founders and friends Anil Lall and VN Saroja, Sanjeev launched Naukri.com in 1997 with 1000 job listings collected from various newspapers. Job seekers learned that job search on Naukri.com was free and traffic slowly started growing mainly through word of mouth.

In the early 2000s, Naukri went on to become a household name amongst the job seekers and a popular hiring website for corporate recruiters in India. The site started monetizing from its corporate (B2B) clients mainly and almost kept the site free for the job seekers.

It was just a small idea and went on to become a multi-million-dollar business. Naukri is a true success example of the first class of Indian dotcom startups.

Did you know? You can create your own job portal with NCrypted’s Job Board Software – Jobgator without any coding skills as it is absolutely ready-to-go!

Jeevansathi.com

Thanks to the profits that Naukri.com generated, Info Edge later on bought India’s then premier online matrimony site Jeevansathi.com in 2004 for a mere 2.76 Cr Rs. (US $628k during that time). Jeevansathi.com was launched earlier in 1998 as an online matrimony matchmaking service provider.

Fueling Other Dotcom Businesses on Naukri’s Success

After the acquisition of full stake in Jeevansathi, the next year (2005) Info Edge started online real estate portal 99Acres.com.

The following year, Info Edge went public with a 722 cr Rs. IPO in 2006 (equals to almost US $164M in 2006) and became the 1st listed dotcom company in India.

Naukri contributed to the success and growth story of the parent company Info Edge as was evident with its later acquisitions, dotcom launches and IPO.

Although bootstrapped in the early years, Info Edge was successful in attracting private equity from ICICI IT Fund, Kleiner Perkins Claufield & Byers, Sherpalo LLC, Murugan Capital etc.

Investing in Zomato and PolicyBazaar

In case you aren’t aware, Info Edge currently holds stake in other Indian startups including two unicorns – Zomato (Restaurants Review turned into Food Delivery Startup) and PolicyBazaar (Insurance Aggregator). Listed on India’s NSE and BSE, Info Edge has a market cap of almost 35,000 Cr. Rs, which is equivalent to US $5 billion.

Rediff.com – From the First Kid on the Block to Becoming the Forefather!

Ajit Balakrishnan co-founded Rediffusion, now known as Rediffusion DY&R (Dentsu Young & Rubicam) when he was 22. He later on founded Rediff on the NeT in 1995, which later on became Rediff.com and a highly successful internet site cum web portal, and got listed on NASDAQ in 2001.

Ajit, a PG Diploma in Management and MBA from IIM Calcutta (1971), is arguably the forefather of the Indian dotcom era, even for the first class as Rediff.com was launched in a time that saw contemporary launches of Hotmail.com, Yahoo and Amazon in the US. Even Google was founded a year after! Thinking of starting an internet company in 1995 in India and that too for the Indian users who did not even had proper dial-up connections required solid confidence in the future of internet consumerism in India.

A dotcom in 1995 India!

I personally am not aware of any Indian dotcom venture successfully launched before Rediff in India that remained active even a year after. Although I was still in my early teens when Rediff was launched, my first email address was on both Yahoo! and Rediff in 1998 and little did I know back then how fascinating the startup ecosystem would become in years to come, following Rediff.

1995 to 2000 was a time when the internet users were getting online primarily for surfing information, reading news and chatting with unknown ‘date’. Rediff amalgamated all of this into a web portal. The internet users of 1990s were different from the toddlers of 2010s which was evident in the kind of dotcom startups that came and became successful in that time.

A new trend was established with the introduction of free email services by Hotmail in 1994-5 and Rediff caught the opportunity very well by introducing Rediffmail.

For years, Rediff was one of the Top 5 most visited sites in India and arguably the only top visited Indian site in the list. Following the tremendous success and user traffic, Rediff went for an IPO on NASDAQ in 2001 to become the first Indian dotcom company to list on the US stock exchange.

In early 2000s, Rediff added other services and features to its portal including Shopping, Hotel Reservation, Job Search etc.

Struggling to Keep Up with the Emerging Trends

However, Rediff seems to have struggled pivoting to the emerging trends in the dotcom startup scene in India in late 2000s and early 2010s. The traffic has continuously dropped as today’s internet users find web portals such as Yahoo! and Rediff to be unattractive.

In April 2016, the company decided to delist from NASDAQ, citing the high cost of reporting requirement, given its worsening financial condition. Rediff.com’s reported revenues in 2019 stood at 48 Cr. Rs. which is equivalent to about US $7 million – a far cry from its contemporary dotcom companies that started during the same time such as Info Edge (US $5 billion market cap), Hotmail (sold to Microsoft in 1997-8 for $400 million) and others. Despite its dropping popularity, Rediff is still credited with literally starting the first-class dotcom wave in India and has left a lot of learning lessons for the same and next generation of entrepreneurs.

Hotmail – Poster Boy of the First DotCom Era with an Indian Connection

Sabeer Bhatia became an overnight celebrity amongst the Indian software diaspora and was hailed by the media at large, when Microsoft announced buying Hotmail.com was a reported $400 million in December 1997.

Neither Hotmail nor Sabeer Bhatia were Indian based in India at the time, but an Indian-origin techie’s involvement as a co-founder in such a multi-million-dollar deal was, in a way, a new age Indian dream come true for everyone back then. Sabeer Bhatia’s pathbreaking sell deal with Bill Gates was also no less than a Bollywood blockbuster, if you literally go by the way media described the event.

Hotmail was founded by Sabeer Bhatia and Jack Smith in 1996, and was one of the first web-based email service along with RocketMail which was later on bought by Yahoo! and renamed to Yahoo! Mail in 1997.

A free Web-based Email – Such a Simple Idea!

Before Hotmail and RocketMail, free email exchange over the internet was not possible as e-mails were sent and received by using protocols and services provided by ISPs (Internet Service Providers). An email free from the ISP-based system was an innovative idea that was well executed resulting in creating disruption in a new market.

Hotmail is one of the few lucky success stories in the startup world that saw such a tremendous success in terms of user reception, growth and high-profile exit – all within a year since its inception! Perhaps this added to its hyped media reception world-over, especially in India and the US as such overnight success stories don’t happen every day.

After the sell off to Microsoft, Sabeer Bhatia later on ventured into several adventures including an online travel portal and e-commerce firm Arzoo Inc. in early 2000s. Arzoo did not kick off and Bhatia later on founded JaxtrSMS, a free messaging service. He said JaxtrSMS will disrupt the SMS industry the way Hotmail did to email. JaxtrSMS till date has failed getting any meaningful user reception and with the data plans becoming cheaper in early 2010s along with the emergence of messaging services like Skype, WhatsApp etc., SMS anyway has lost its charm with messaging becoming effectively zero.

Unfortunately, Sabeer Bhatia has not seen another success till date that could come even close to Hotmail. Being lucky helps sometimes, especially when you launch the right product at the right time! Timing can be contributed as the No. 1 factor when measuring any startup’s success. And timing often is not within our hands and hence luck plays its part!

Shaadi.com – Pioneering Arranged Marriages over the Internet

“Arranged marriages over the internet was a laughable idea when Shaadi.com started” says Anupam Mittal who founded Shaadi.com in 1997. Anupam founded Shaadi.com when he was 34-year-old and was originally named Sagaai.com.

Arranged marriages over the internet was a laughable idea when Shaadi.com started

Anupam Mittal – Shaadi.com

Shaadi.com initially struggled getting any meaningful revenue in terms of paid memberships as the conservative Indian parents were reluctant in signing up profiles for their wannabe grooms and brides back in 1990s and early 2000s. Not to forget, internet adoption was also poor at that time across India. The idea of finding your life partner over the internet on a random strange website did not click to the people’s mind.

Local Solution for a Local Problem

Notably Anupam was still a bachelor himself when Shaadi.com was launched and soon realized that it can’t be run like a dating site in the Western world. So Shaadi.com introduced search across many categories that parents would normally use and care about when searching for the life partner for their kids. Such categories and filters included Caste, Religion, Preferred City (if Relocation as brides are expected to move to the groom’s house and location post marriage), Astrology, Manglik/Kuja Dosham and many others. Yes, many profiles were created by parents themselves on behalf of the candidates themselves. Also, unlike a dating site, matrimony was more of a serious issue and the target audience were conservative and orthodox parents, so all profiles were required to go through manual review by the admin before it can be published for the others to view. And, all of these local changes made the concept work!

Slowly the adoption started increasing and Shaadi.com went on to become a household name for online matrimony and became popular in India, Pakistan and Bangladesh as well as amongst Non-Resident-Indians (NRIs) in particular.

Following the success of Shaadi.com and using its profits, the parent company People Group later on launched Makaan.com (online real estate portal) and Mauj (mobile media company) in 2003.

Investing in Ola Cabs

People Group has also invested in other high-profile startups in India including Ola Cabs and Druva. Surprisingly, Shaadi.com acquired Thrill Group in 2016, a startup that had two online properties in its kitty namely FRIVIL and Fropper. Fropper was founded in 2003 and saw almost all possible pivots an online community site can possibly have in those times, including friends search, dating, social networking, ‘bit of’ matrimony-oriented matchmaking until getting shut down in 2019. I will cover more on Fropper.com in the second class series.

BharatMatrimony

Murugavel Janakiraman started BharatMatrimony in 1997 and later on met his to-be-wife through his own matrimony site! A reward can’t get more personal than this, I would say.

Murugavel, while working as a software consultant for Lucent Technologies in Edison, N.J., set up a Tamil community web portal that included matrimony ads as well. He noticed that matrimonial ads generated most of his web traffic and thought of pivoting early to setup a website only for matrimony services which became BharatMatrimony.

But that did not mean overnight success. Tamil community overseas were using the site but the traffic was not big enough to help sustain future growth. And back in India, people were reluctant in paying online for a matrimony service. Murugavel again had to innovate early and find a local solution to the problem by introducing doorstep collections in India. Slowly this feature started picking up among the users and premium (paid) memberships started increasing.

Murugavel returned to India in 2004 (during the release of Swades movie!) and in 2006 the website earned Limca Book of World Records for having facilitated the highest number of documented marriages online in India.

In 2013, Yahoo! bought a 12% stake in BharatMatrimony for Rs. 100 Cr., valuing the company at 900 Cr., equivalent to US $155 million at that time’s conversion rate.

Shaking up Old Industries

Murugavel’s BharatMatrimony along with Anupam Mittal’s Shaadi.com and Sanjiv Bikhchandani’s Jeevansathi.com together shook up the newspaper-based matrimony classified ads industry with their online matrimony websites.

However, as we read this in 2020, much has changed after the previous shook up and unless further disruption happens, traditional online matrimony might see a shake-up themselves in early 2020s much the same way they shook up the newspaper based matrimony classifieds in early 2000s. As Indian millennials aggressively become addictive in finding life partners over other emerging online services such as Tinder, Facebook, Instagram and even on TikTok, the future seems challenging for such services.

The good news is that matrimony remains a very Indian concept till date and is popular among the people residing and belonging to the Indian subcontinent. Millions of marriages are still arranged and even love marriages are still ‘approved’ by Indian parents and families. As long as this trend continuous and unless there is a new shake up in this industry, matrimony sites will still have a future.

Matrimony.com Today

Traded as Matrimony.com on NSE, Matrimony.com Ltd. has a market cap of 865 Crore Rs. (US$125 million). This is 5x lower than the valuation at which Yahoo! acquired equity in the company back in 2013. However, after going public, the company has not seen that kind of valuation ever and its pick in January 2018 was at around 2.5x of its current market cap (approx. US$370 million) which again was half of what Yahoo! valued the business to be worth in 2013. This perhaps talks of the declining time of the online matrimony and marriage related matchmaking services, especially given the rise and popularity of social networking and dating services such as Facebook, Tinder later in late 2010s world over and in India as well.

Justdial

Justdial was founded by VSS Mani in 1996 as a web-based directory. DMoz and Yahoo! Directories were the popular global sites and VSS Mani saw the need for an Indian directory during that time. However, the concept of Justdial was very different from Yahoo! directories as the latter was focusing mainly on the website catalog wherein Justdial was more about the online listings of traditional establishments and businesses that were offline.

Yellow Pages with a Calling Option

VSS Mani worked for a yellow-pages company before founding Justdial and thought of bringing the calling/call back feature to it with the introduction of a web-based directory of local business listings. Google expanded this concept with local search later in 2010s, however it was Justdial that made the feature and concept popular for markets like India.

I still remember using Justdial web app from my Blackberry phone 2007 when we had to search for a restaurant we wanted to go in and eat and calling them to find out the menu before we decided where to go – the experience of being able to find restaurants and call them with an ease seemed like the next-big-thing back then.

Justdial is another great example of a bootstrapped startup that went on to become successful and give handsome returns to its investors and create value for consumers, employees and everyone involved in the value-chain. It started with a seed capital of 50,000 Rs. in 1997 and after a long journey of establishing itself as a brand amid high profile competition from giants such as Google and Yahoo!, went public with a successful IPO in 2013.

Justdial Today

The company’s revenues in 2019 stood at 984 Cr. Rs. (equal to US $140 million) and currently has a market cap of 2,430 Cr. Rs. (about US $350 million).

Contests2Win

Alok Kejriwal created Contests2win in 1998. It was created on an idea to let people content online that later on spearheaded the creation of digital promotions across several countries including India and China. Contests2win merged advertising and gaming together and was a unique idea for that time.

Users got attracted to the possibility of earning some quick bucks by participating and winning in online contests on the site. As the traffic grew, so did the advertisements from some of the most established Fortune 500 brands such as Pepsi, Nestle and L’Oreal. Not only the global advertisers, the success of Contests2win also grabbed some global investors attention including Softbank. Contests2win was arguably one of Softbank’s very first investments in an Indian internet startup, way back in 2000!

TV-Powered SMS Contests

Following the success of Contests2win, Softbank invited Alok and his team to China with a pivot concept of Contests2win in mind, called Mobile2win. Mobile2win’s business model was TV-powered SMS contesting and soon became a hit amongst popular television shows. Following the success in China, in 2002 Mobile2win was launched for the Indian market and grabbed the contract from Indian Idol for the first ever television-powered SMS response campaign in India.

Selling to Walt Disney

In 2006 Alok successfully sold Mobile2win China to Walt Disney and its Indian business to Norwest Venture Partners.

Alok today is the CEO and Co-founder of Games2win, his fourth company and also runs TheRodinHoods.com, a blogging site to help entrepreneurs with guidance mostly through Alok’s posts.

Fabmart a.k.a. Indiaplaza – India’s First E-Commerce Startup!

In June 1999, K Vaitheeswaran and five of his friends co-founded Fabmart.com, India’s first online departmental store. This was some 8 years before Flipkart was founded and Amazon entered the Indian market! Unfortunately, and surprisingly enough, hardly anyone would know or remember this site today. Despite having the first mover’s advantage and secured funding from elite venture funds, Indiaplaza’s failure story is one that got many eyeballs when K Vaitheeswaran published his story in the book ‘Failing to Succeed – The Story of India’s First E-Commerce Company’ in 2017.

Fabmart had to shut down in 2013 and four of the co-founders then went on to start BigBasket which went on to become another unicorn that with Fabmart they all failed to achieve.

The website Fabmart.com originally only offered music CDs for sale. In 2000, more categories were introduced including books, movies, watches and groceries. Online shopping was still a distant reality for the average Indian consumer in those days as the infrastructure, economy and consumer mindset were not ready.

First Mover or Too Early to Market?

Fabmart is credited with several of India’s firsts including the creation of India’s first online departmental store FabMart, India’s first online retail store FabMall, India’s first online marketplace, integration of India’s first PIN-based payment gateway system, the innovative Cash-On-Delivery (COD), e-wallets, electronic gift cards, omnichannel setup and hyperlocal experience for internet consumers. Reportedly Vaitheeswaran did not know these jargon back then but the concepts were pioneered from the grounds up by reading user feedback and getting them implemented as per the local environment.

Fabmart indeed enjoyed the first mover’s advantage but was probably too early in the market at that time. Consumers did not have enough credit cards and only a couple of online payment gateways were entertaining Indian cards, that too by charging hefty fees for online transactions. This created a lot of trouble for the company to be able to sell enough volume online which forced it to go offline with its first offline grocery store in Bangalore, India.

The company saw several rebranding in the early years as it got renamed to Fabmall from Fabmart in 2001 and then later on to Indiaplaza after acquiring the US based online shopping site Indiaplaza.com. Even then two sites were kept to address audiences in the USA and India separately with Indiaplaza.com and Indiaplaza.in respectively, only to be again merged to create a single identity later on. So many branding changes in quick succession during the early adoption time created a confused identity amongst the consumers and did not help Indiaplaza create a strong brand recall before the much stronger competition came to the market when the market became mature enough.

What went wrong with Indiaplaza?

K Vaitheeswaran primarily holds the bullish investors responsible for what happened to startups like Indiaplaza. The emergence of new e-commerce companies in late 2000s in India such as Flipkart, Snapdeal, Myntra, Amazon India and their ability to secure massive amount of money to become unicorns in a couple of years without ever making any meaningful profit took a lot of time for grounded entrepreneurs like Vaitheeswaran to understand the digest. Something similar happened to TaxiforSure which pioneers the app-based taxi booking service in India, before Ola Cabs. Despite having profitable quarters, lack of fundraising compared to the rival killed these startups that were founded by business savvy founders who failed to understand the unicorn mentality of the new age breed that were to follow in late 2000s and early 2010s.

Struggles with Investment and Investors

Indiaplaza was still able to secure $5 million from Indo-US Venture Partners (IUVP – later on rebranded as Kalaari Capital) who had previously also invested in other internet companies like Myntra and Snapdeal. But, $5 million was not enough given the fact that the rivals were able to raise tens and hundreds of millions in successive quarters enabling them to fuel their growth with heavy discounts. Indiaplaza although was profitable at unit level, had to fight the competition neck-to-neck and discounting seemed as the only option given the new discounting habit the Indian consumer was getting used to. Despite several attempts, it was unable to raise any more funding rounds in 2012-13 and due to lack of any discounting strategy, traffic became almost zero. Indiaplaza had to cease trading in early 2013, marking the end of the first e-commerce startup and era in the country!

In his book and elsewhere in several articles, Vaitheeswaran is also blaming Vani Kola of Indo-US Venture Partners (Kalaari Capital) of not been supportive in successive funding rounds or even helping Indiaplaza find other investors. There were hints that the investment into Indiaplaza by the said venture fund was made not to help but to try to stall its growth, due to the fund’s deep involvement in other existing competing portfolio companies such as Myntra and Snapdeal.

True or false, only Vaitheeswaran would know. But, such hostile shut downs and takeovers are not new to the startups and businesses world over. Only the strong is able to survive.

First mover or Eventual Loser?

And sometimes first movers end up becoming losers by doing all the charity innovations for the later comers to copy! Globally and especially in the Silicon Valley such stories are plentiful as well. Remember what happened to Myspace and Friendster after Facebook entered the market. Remember what happened to Lycos, Astalavista after Google. Remember what happened to Webvan, an idea later on implemented by Amazon!

After 2017 when validation started happening in the e-commerce market in India and world-over in a way with once $5 billion valued company Snapdeal slipping less than a billion in private valuation and losing its unicorn status, Vaithee’s words almost sound prophetic:

“Where I went completely wrong was in assuming that by staying away from the deep-discount game and continuing to focus on building a profitable business, we would be around — and much stronger — as and when sanity returns to the e-commerce business. Sanity returned late, but we died early. What really hurt was the way we died.”

K Vaitheeswaran – Co-Founder FabMart/IndiaPlaza

MouthShut.com – India’s First Consumer Review Website

MouthShut.com was founded by Faisal Farooqui in 2000 in Mumbai. The website hosts reviews of gadgets, restaurants, travel destinations, movies, with several other categories and has been in almost the same business model since inception without ever pivoting which is rare in startup fraternity, but is found more common among bootstrapped ventures. MouthShut.com till date remains a bootstrapped company.

MouthShut’s business was based on Yelp and somewhat TripAdvisor. However, while Yelp only focused on restaurant and hotels reviews back then, MouthShut allowed reviews on broader spectrum of categories. MouthShut monetizes this content through online advertisements.

Still a profitably run company, MouthShut came in highlight for a court case in 2015 instead of its core business. In 2015, MouthShut.com won the case against the Government of India for striking down some sections of the Information Technology Act, 2011. As a result of this ruling by the Supreme Court of India, users are now free to post anything on the internet which was earlier restricted in a way under the IT Act.

While still getting a good amount of traffic on its website, it has eventually dropped down in last few years and it is yet to be seen how long it will be able to survive with the same business model and concept.

But, overall MouthShut has played a piloting role and laid the foundation in terms of market awareness and consumer readiness for the future consumer review centric startups such as Zomato which started with customer reviews only for restaurants.

MakeMyTrip – India’s First Online Travel Agent

Founded in 2000 by Deep Kalra (an IIM Ahmedabad alumnus), MakeMyTrip pioneered online travel (airlines, hotels) booking in India and created waves with the introduction of categorized holiday packages that include the entire tour – hotel booking, air tickets, pick up and drop as well as sight-seeing.

Deep Kalra saw an emerging need among the overseas Indian community in the US for the India travel needs and hence MakeMyTrip was initially launched only for the US market in 2000 before launching for the India market in 2005.

Customizing for the Indian Consumers

The strategy was well planned, as Deep was aware of the lack of consumer readiness for such a service in India back in 2000 wherein it made more sense and had an immediate need amongst NRIs in the USA.

Even after launching the site in India, instead of simply offering air ticket booking, MakeMyTrip customized its core service offering and pivoted to suit the local Indian consumer mindset by providing packaged holiday tours for both air and non-air. This was an instant hit and in late 2000s and early 2010s and resulted in tremendous growth in holiday tours being booked, especially the honeymoon tours, by Indian users who wished to travel abroad and needed hand holding.

Going Public

MakeMyTrip went public with a successful listing on NASDAQ in 2010. In 2016, the Chinese travel booking company Ctrip invested $180 million in MakeMyTrip. Meanwhile the company also acquired several companies including Ixigo.com in 2011, Thailand’s ITC Group in 2012, EasytoBook.com in 2014, MyGola and Holiday IQ in 2015, Ibibo Group in 2017.

Ibibo Acquisition

Interestingly enough, Ibibo previously acquired India’s most popular online bus ticketing platform redBus.in in 2013, which was one of India’s biggest internet deals overseas at that point of time. The deal was estimated to be worth 600-700 Crore Rs. redBus was founded by Phanindra Sama and two other co-founders in 2006. More about redBus’s startup journey and lessons to learn in the second class series.

MakeMyTrip’s acquisition of GoIbibo Group was one of India’s biggest deal in online travel space. Post the deal, South Africa based Naspers and China based Tencent Holdings became the largest shareholders in MakeMyTrip. The combined company formed India’s largest travel group.

The OYO Situation

MakeMyTrip meanwhile saw emerging competition from OYO Rooms in 2015. OYO’s strategy apparently was based on its property listings on MakeMyTrip and other travel portals. This resulted in duplicate listings on MakeMyTrip as many of those hotel properties would be already listed under their original name (compared to the other listing under OYO’s made up names) and created confusion among its users and loss of potential revenues for MakeMyTrip. As a result, MMT decided to block OYO from across its platforms including makemytrip.com, goibibo.com etc. This was followed by other OTAs in India blacklisting OYO from listing any property on their platforms.

Eventually however, in 2018-19 OYO partnered up with MakeMyTrip through a deal to get its properties listed again on the MMT platform and partner sites by promising to pay a fixed booking and listing fee. It will be interesting to see how long does this loves-me-loves-me-not situation continues between them.

MakeMyTrip Today

MakeMyTrip lately has seen steady growth in terms of traffic and revenues. The company’s revenues in 2018 were US$675 million but in 2019 dropped to US$486 million. It’s market cap as of date is $US 1.58 billion, which for a short time in 2018 went up to $3 billion.

How are the First Class of Indian Startups different from their Silicon Valley Counterparts?

US and the Silicon Valley in particular saw its first class of Internet Startups by the end of the 20th century with Yahoo!, Google, Amazon, eBay and dozens of others now defunct dot-coms starting their shops from 1994 to 2000.

In case you are wondering, I am referring to the earlier giants such as Microsoft and Apple (with Infosys, Wipro etc. in India) as the businesses of pre-dotcom startup era. All of these were startups but the word startup came into lime light much later. For the matter of fact, any business with humble beginning is a startup. Typically these startups have service offerings or products that are innovative or are not currently being offered elsewhere in the market, or at least the founders have such firm belief. For example, a retail grocery shop cannot be considered a startup with this definition; but on demand grocery delivery apps like Grofers, Instacart are.

Silicon Valley has a closed circle of influence and the founders there enjoy the same school of thought which is not available in India. In India the startups had to be born, you could not simply inherit the model from the ecosystem as there was none. Starting up in itself was a big challenge for the First Class of Indian Startups. Those were the times when these founders were struggling with questions whether to startup or join big MNCs paying handsome paychecks. Starting up might seem like an exciting thing in today’s India as there are several startup incubators available, although to me, most of them are still impractical and lack the required networking and mentoring. However, for the first class startups of India, it was like starting a manufacturing factory during the license raj. There was a complete vacuum of mentoring on starting up.

The startup ecosystem in India back in that time was pretty lame and there was almost no funding guidance or opportunity available except for only some privileged founders. There were no smartphones and the only places people could access internet were either their office or from the cyber café. These founders forged ahead nonetheless. They had to learn on their own, they had to start, experiment, fail, do it again – all before your own bootstrapped cash dries up. In the middle of this, if you get some taste of success in terms of some user traction, scaling up became another big problem as nobody had done this before. “Sometimes when you see Silicon Valley startups scaling rapidly”, adds Sridhar Vembu of Zoho, “that’s because people came together from, they already had prior experience and they came together in this place to just scale it up rapidly.”

In India, we didn’t have that luxury during the first class. In fact, even today our startup ecosystem is not that grown up comparatively.

What’s Next

The Second Class! Stay tuned and subscribe to the blog in order to get notified when the second class article is published.

Do share your comments and thoughts about the First Class of the Indian Startups of the Internet Era. Have I missed any notable startup worth mentioning? What is your take?